NetSpend's Troubles Mount: The Story Of Their Recent Arrest - A Dive Into the Drama Surrounding the Prepaid Card Issuer

In the world of fintech, few companies have made a name for themselves as prominently as NetSpend. For years, the prepaid card issuer has been a staple in the industry, offering convenient and secure payment solutions to millions of customers across the United States. However, in recent times, NetSpend has found itself at the center of a media storm, with reports of financial troubles and a high-profile arrest making headlines. In this article, we'll delve into the details of NetSpend's recent woes, exploring the root causes of their struggles and the implications for their customers.

NetSpend's Rise to Prominence

NetSpend was founded in 1999 by Ken Harl and Jeff Alleck, with the goal of creating a prepaid card issuer that would offer a more secure and convenient alternative to traditional bank cards. The company's early success was largely driven by its partnerships with major retailers, including grocery stores and convenience stores, which helped to establish NetSpend as a household name. Over the years, NetSpend has expanded its services to include a range of features, including online banking, mobile banking, and cardless withdrawals.

Despite its initial success, NetSpend has faced numerous challenges in recent years. The rise of mobile payments and digital wallets has forced the company to adapt and innovate in order to stay ahead of the competition. Additionally, NetSpend has struggled to keep pace with the increasing regulatory demands placed on the fintech industry.

The Recent Arrest: A Turning Point for NetSpend?

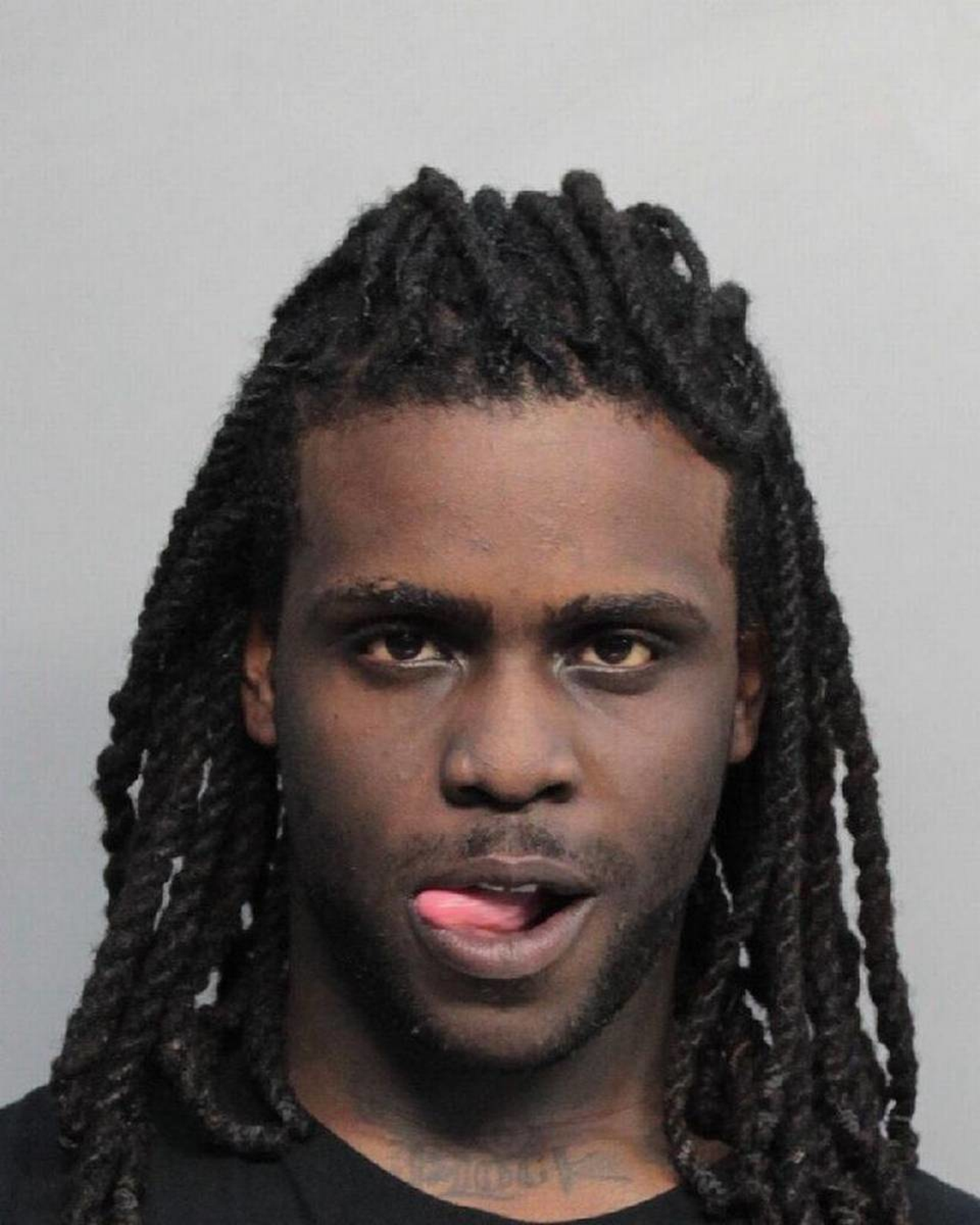

In May 2022, NetSpend was embroiled in a major scandal when a former employee was arrested and charged with conspiracy to commit wire fraud. The arrest sent shockwaves through the industry, with many experts questioning the severity of the charges and the potential impact on NetSpend's reputation. In this section, we'll take a closer look at the details of the arrest and its implications for the company.

The Allegations Against NetSpend

According to court documents, the former employee, identified as [Name], was accused of conspiring with other individuals to defraud NetSpend out of millions of dollars. The allegations, which included charges of wire fraud and conspiracy, were allegedly related to a series of unauthorized transactions that took place on NetSpend's network.

The investigation, led by the Federal Trade Commission (FTC), found that [Name] had created a series of fake accounts and accessed NetSpend's systems using stolen login credentials. This allowed [Name] to withdraw funds from the accounts and transfer them to their own bank accounts, totaling over $1 million in losses.

The Aftermath of the Arrest

In the aftermath of the arrest, NetSpend has faced intense scrutiny from regulators and industry experts. Many have questioned the company's internal controls and governance procedures, which some argue failed to detect the alleged wrongdoing.

In response to the allegations, NetSpend has stated that it takes the allegations "very seriously" and is cooperating fully with the investigation. The company has also assured its customers that it is taking steps to strengthen its internal controls and prevent similar incidents in the future.

Financial Troubles: The Root Cause of NetSpend's Woes

Despite its recent arrest, NetSpend's financial troubles predate the alleged wrongdoing. In recent years, the company has faced increased competition from newer prepaid card issuers and rising regulatory costs.

The rise of mobile payments and digital wallets has also forced NetSpend to adapt and innovate in order to stay ahead of the competition. This has led to significant investments in new technology and infrastructure, which have put a strain on the company's finances.

Challenges in the Fintech Industry

The fintech industry is highly competitive, with numerous players vying for market share. NetSpend faces stiff competition from companies like Visa, Mastercard, and American Express, which offer a range of prepaid card solutions.

In addition to this, the fintech industry is also subject to increasingly stringent regulatory requirements. The Payment Card Industry Data Security Standard (PCI-DSS) and the Gramm-Leach-Bliley Act (GLBA) are just two examples of the regulations that NetSpend must comply with.

Regulatory Costs and Compliance

Regulatory costs and compliance are a significant burden on NetSpend. The company must invest significant resources in ensuring that its systems and processes meet the required standards, which can be costly and time-consuming.

In addition to these costs, NetSpend must also navigate a complex regulatory landscape, which can be challenging and often contentious. The company must balance its compliance obligations with its business needs, which can be a difficult task.

Implications for NetSpend's Customers

The recent arrest and financial troubles have significant implications for NetSpend's customers. Many are left wondering whether their prepaid cards are secure and whether they can trust the company to handle their finances.

In this section, we'll take a closer look at the potential implications for NetSpend's customers and what they can do to protect themselves.

Protecting Yourself as a NetSpend Customer

As a NetSpend customer, there are several steps you can take to protect yourself:

- Regularly review your account statements to detect any suspicious activity

- Monitor your card for any unauthorized transactions

- Report any discrepancies or concerns to NetSpend's customer service department immediately

- Consider exploring alternative prepaid card options

Rebuilding Trust

NetSpend's recent woes have undoubtedly eroded trust in the company. However, the company's commitment to its customers and its efforts to strengthen its internal controls can help to rebuild this trust.

In conclusion, NetSpend's recent arrest and financial troubles are just the latest chapter in the company's ongoing saga. As the fintech industry continues

Is Tony Hinchcliff Married

Candy Mansoneath

Gaz Coombes Wife

Article Recommendations

- Madison Beer Parents

- How Old Isavid Muir Wife

- Mel Tiangco

- Who Isavid Muirs Wife

- Mikaylah

- Carly Jane Fans

- Abby Bernerd

- Meg Nuttd

- Simon Cowell Funeral

- Lee Ingleby