Tennessee Tax Guide 2025: Unlocking Tax Savings & Benefits For State Residents

Tennessee is known for its tax-friendly policies, and for good reason. The state offers a range of tax benefits and savings opportunities that can help residents reduce their tax liability and keep more of their hard-earned money. As the 2025 tax year approaches, it's essential for Tennessee residents to understand their tax obligations and make the most of the tax savings and benefits available to them.

Tennessee's tax code is complex, but by understanding the basics of state taxation, residents can avoid costly mistakes and ensure they're taking advantage of all the tax savings available to them. In this article, we'll delve into the world of Tennessee taxes, exploring the state's tax laws, tax credits, and tax deductions. Whether you're a first-time resident or a seasoned taxpayer, this guide will provide you with the information you need to unlock tax savings and benefits in the Volunteer State.

Understanding Tennessee Tax Laws

Income Tax

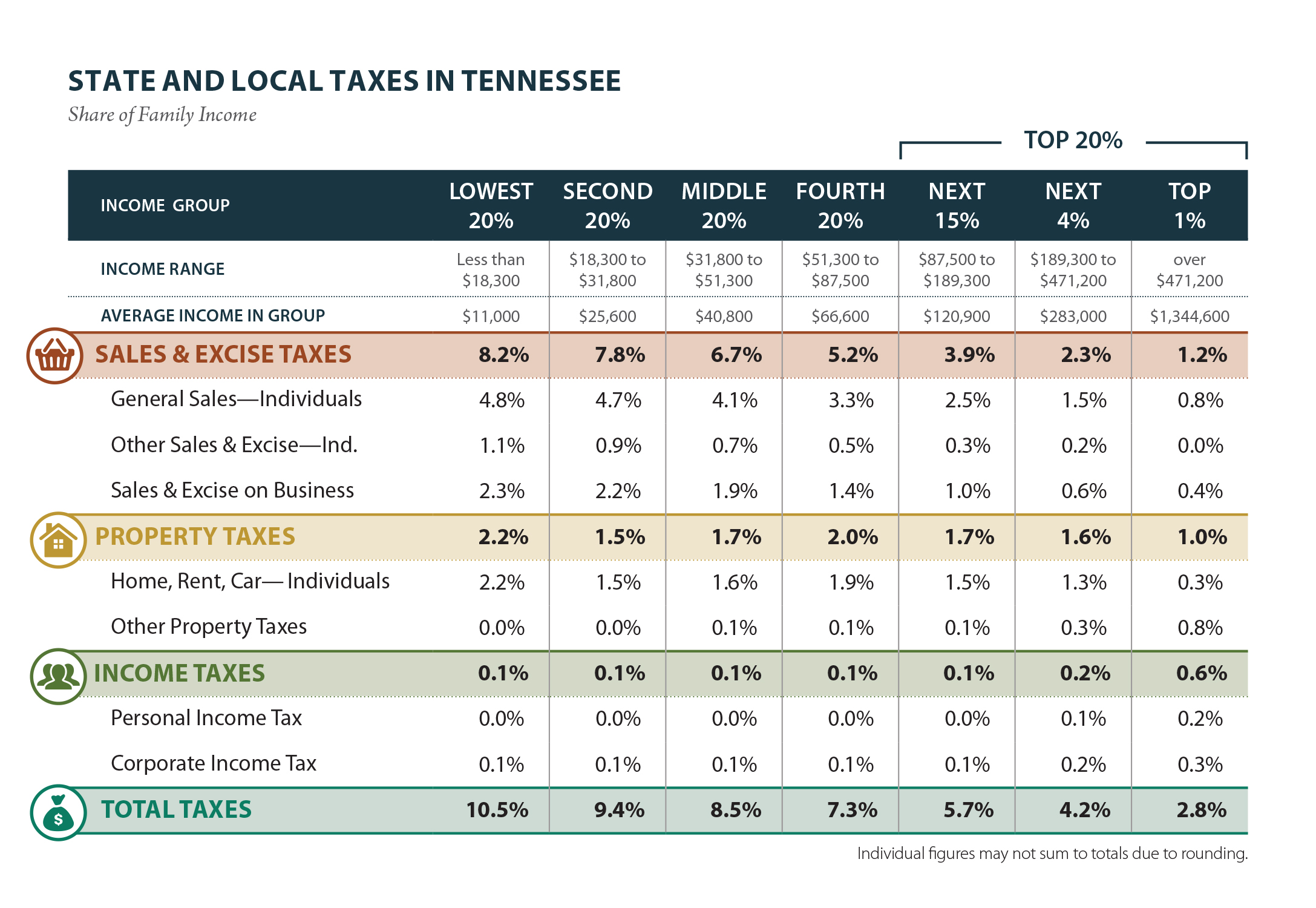

Tennessee is one of the few states that does not tax income. This means that residents will not have to pay state income tax on their earnings. However, there are some exceptions to this rule. For example, residents may be subject to federal income tax, and certain types of income, such as interest and dividends, may be subject to state taxes.

• Tennessee residents who earn income from out-of-state sources may be required to pay state taxes on those earnings.

• Self-employed individuals and small business owners may be eligible for a reduction in their state tax liability through the Tennessee small business tax credit.

• Certain types of investments, such as real estate and businesses, may be subject to state taxes.

Sales Tax

Tennessee has a sales tax rate of 7%, which is among the lowest in the country. However, sales tax rates can vary depending on the location and type of goods or services being purchased. Some cities and counties in Tennessee also impose local sales taxes, which can range from 0.5% to 2.5%.

• Residents can purchase exempt items, such as groceries and prescription medications, tax-free.

• Online retailers may be required to collect and remit sales tax, even if the purchase is made from a location outside of Tennessee.

• Small businesses and entrepreneurs may be eligible for a sales tax exemption on certain business expenses.

Tax Credits and Deductions

Tax Credits

Tax credits can provide a direct reduction in a resident's state tax liability, and they can be more beneficial than tax deductions, which only reduce taxable income. Some popular tax credits available to Tennessee residents include:

• The Tennessee child care credit, which provides up to $100 in credits per child.

• The Tennessee education credit, which provides up to $100 in credits per year for education expenses.

• The Tennessee homebuyer credit, which provides up to $3,000 in credits for homebuyers.

• Tax credits can be claimed on federal returns as well, and they may be refundable, meaning that residents can receive a refund even if they don't owe taxes.

• Some tax credits may have income limits or other eligibility requirements.

Tax Deductions

Tax deductions can provide a reduction in taxable income, which can lead to a lower state tax liability. Some popular tax deductions available to Tennessee residents include:

• The Tennessee mortgage interest deduction, which allows residents to deduct mortgage interest payments on their primary residence.

• The Tennessee property tax deduction, which allows residents to deduct property taxes on their primary residence.

• The Tennessee charitable donation deduction, which allows residents to deduct donations to qualified charitable organizations.

• Tax deductions can be claimed on federal returns as well, and they may be itemized or standard.

• Some tax deductions may have income limits or other eligibility requirements.

Filing Your Tennessee Taxes

Filing Status

When filing your Tennessee taxes, it's essential to choose the correct filing status. The most common filing statuses in Tennessee are:

• Single

• Married filing jointly

• Married filing separately

• Head of household

• Qualifying widow(er)

• Filing status can affect the amount of state tax liability, so it's essential to choose the correct status.

• Filing status may also affect the amount of tax credits and deductions available.

Income Reporting

When filing your Tennessee taxes, you'll need to report all income earned from various sources. This includes:

• Wages and salaries

• Self-employment income

• Interest and dividends

• Capital gains

• Rent and royalty income

• All income must be reported, even if it's not subject to state taxes.

• Income from out-of-state sources may require special reporting and documentation.

Deduction and Credit Limits

When filing your Tennessee taxes, you'll need to ensure that you're taking advantage of all the deductions and credits available to you. Some limits and restrictions apply:

• The Tennessee earned income tax credit has a phase-out limit of $20,000 for single filers and $40,000 for joint filers.

• The Tennessee child care credit has a phase-out limit of $50,000 for single filers and $100,000 for joint filers.

• The Tennessee education credit has a phase-out limit of $50,000 for single filers and $100,000 for joint filers.

• Limits and restrictions may apply to certain deductions and credits.

• Filing status and income level can affect the amount of deductions and credits available.

Tax Planning and Preparation

Tax Planning

Tax planning is essential for minimizing state tax liability and maximizing tax savings. Some strategies include:

• Maximizing deductions and credits

• Investing in tax-deferred vehicles, such as 401(k)s and IRAs

• Harvesting investment losses to offset gains

• Charitable donations and philanthropy

• Tax planning can be complex and require professional advice.

• Tax planning strategies should be tailored to individual circumstances and goals.

Tax

Aaron Hernandez Wife Net Worth 2024

Chaun Woo Parents Nationality

Zoe Chip

Article Recommendations

- Google Places Rank Checker

- Whenid Piddyie

- Seopetitor Rank Tracker

- Keri Russell Kurt Russell

- Pamibaby

- Maligoshik

- Taylor Mathis

- David Caruso

- Briialexia Fans

- Griffin Musk