Get Ahead of Your Student Loan Debt: A Comprehensive Guide to Federal Loans

The world of student loans can be overwhelming, with numerous options and complexities that can make it difficult to navigate. However, with the right guidance, you can make informed decisions about your federal loans and take control of your financial future. In this comprehensive guide, we will walk you through the process of obtaining and managing federal student loans, providing you with the knowledge and tools necessary to make the most of this critical financial resource.

Understanding Federal Student Loans

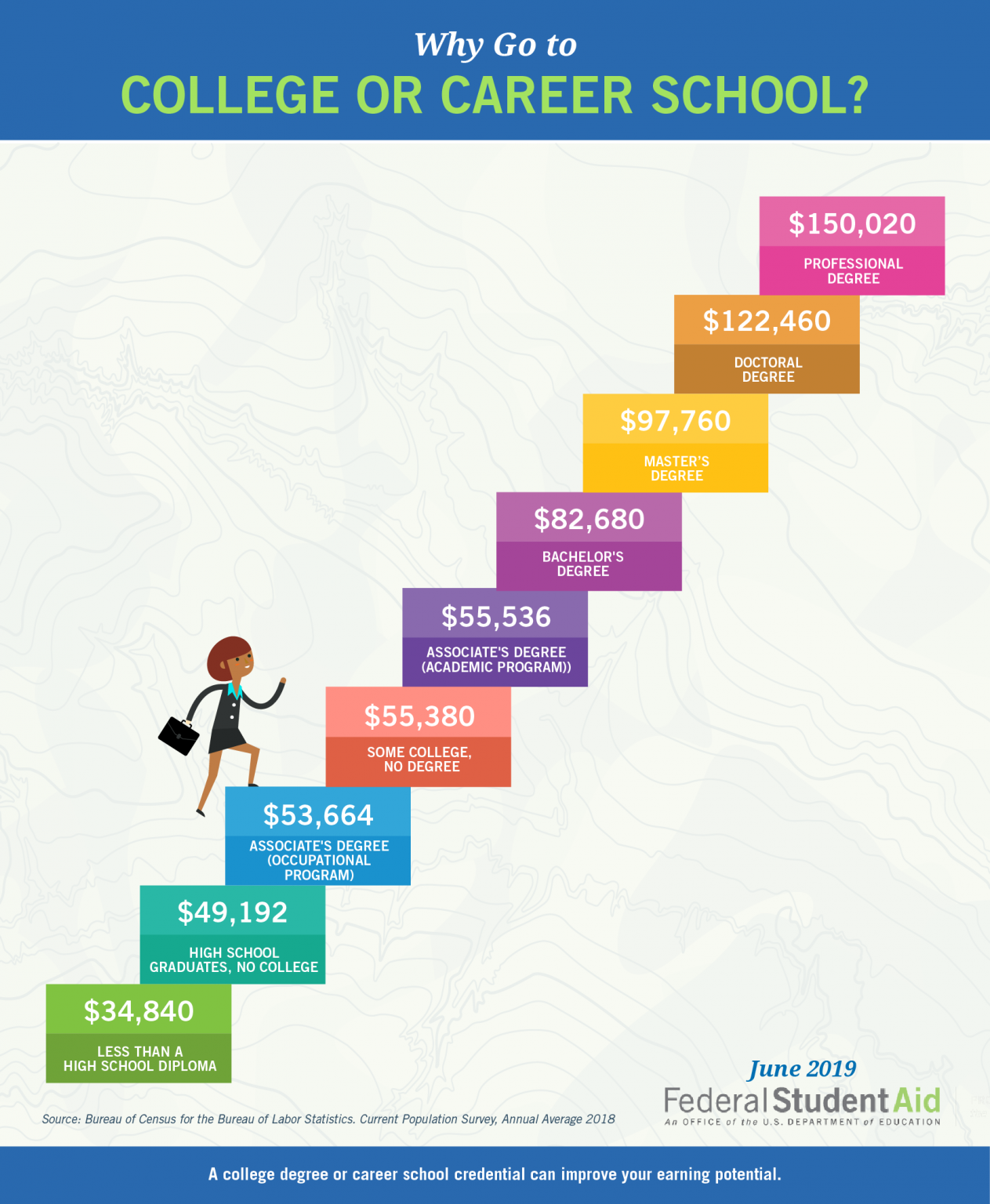

Federal student loans are a vital source of funding for millions of students across the United States. These loans are designed to help students cover the costs of higher education, including tuition, fees, room, and board. The federal government guarantees these loans, making them a more attractive option for students who may not have access to private financing.

There are several types of federal student loans, each with its own set of benefits and drawbacks. The most common types of federal student loans include:

- Direct Subsidized Loans: These loans are available to undergraduate students who demonstrate financial need. The federal government pays the interest on these loans while the student is in school.

- Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students, regardless of financial need. The student is responsible for paying the interest on these loans while they are in school.

- Direct PLUS Loans: These loans are available to graduate and professional students, as well as parents of undergraduate students. The federal government charges interest on these loans, and the student or parent is responsible for paying the interest while the loan is in repayment.

The Application Process for Federal Student Loans

The application process for federal student loans is relatively straightforward. To apply for a federal student loan, you will need to follow these steps:

- Complete the Free Application for Federal Student Aid (FAFSA): The FAFSA is a requirement for most federal student loans. This form will ask for information about your financial situation, including your income, family size, and expenses.

- Check Your Eligibility: Once you have submitted the FAFSA, you will receive a Student Aid Report (SAR) that will indicate your eligibility for federal student loans. You can use this report to determine which types of loans you are eligible for.

- Apply for a Federal Student Loan: If you are eligible for a federal student loan, you can apply online through the Federal Student Aid website. You will need to provide information about your loan application, including the type of loan you are applying for and the amount you are requesting.

- Receive Your Loan Award: Once you have applied for a federal student loan, you will receive a loan award letter that will indicate the amount of the loan you are eligible for. This letter will also provide information about the loan's terms, including the interest rate and repayment schedule.

Managing Your Federal Student Loans

Managing your federal student loans is crucial to avoiding financial difficulties in the future. Here are some tips for managing your federal student loans:

- Make On-Time Payments: Make sure to make on-time payments to avoid late fees and damage to your credit score.

- Keep Track of Your Payments: Keep track of your payments by using a loan repayment calculator or by setting up automatic payments.

- Consider Income-Driven Repayment Plans: If you are having trouble making payments, consider enrolling in an income-driven repayment plan. These plans will lower your monthly payments based on your income and family size.

- Refinance Your Loans: If you have a high-interest loan, consider refinancing it with a lower-interest loan. This can save you money on interest over the life of the loan.

Repaying Your Federal Student Loans

Repaying your federal student loans is a critical step in managing your financial future. Here are some tips for repaying your federal student loans:

- Understand Your Repayment Options: Federal student loans offer several repayment options, including the standard repayment plan, graduated repayment plan, and income-driven repayment plan.

- Consider Prolonging Repayment: If you are having trouble making payments, consider prolonging repayment. This can lower your monthly payments and give you more time to repay the loan.

- Make Extra Payments: Making extra payments can help you pay off your loan faster and save money on interest.

- Consolidate Your Loans: If you have multiple loans with high interest rates, consider consolidating them into a single loan with a lower interest rate.

Additional Resources

There are several additional resources available to help you manage your federal student loans:

- Federal Student Aid Website: The Federal Student Aid website offers a wealth of information about federal student loans, including repayment options and income-driven repayment plans.

- National Foundation for Credit Counseling: The National Foundation for Credit Counseling offers free credit counseling and debt management services.

- Student Loan Counseling: Many colleges and universities offer student loan counseling services. These services can provide you with personalized advice and guidance on managing your federal student loans.

Frequently Asked Questions

Here are some frequently asked questions about federal student loans:

- Q: How do I apply for a federal student loan?

A: To apply for a federal student loan, you will need to complete the FAFSA and check your eligibility. You can then apply online through the Federal Student Aid website. - Q: What is the interest rate on federal student loans?

A: The interest rate on federal student loans varies depending on the type of loan and the date it was disbursed. Undergraduate Direct Subsidized Loans have an interest rate of 4.53% for the 2022-2023 award year. - Q: Can I make extra payments on my federal student loan?

A: Yes, you can make

Patrick Fugit

How Tall Was Lorne Greene

Tony Hinchcliffe Relationship

Article Recommendations

- Zoe Chip

- Cinemas 2021

- Dennis Tissington Verdict

- Sophie Raiin

- Orlando Browniddy

- Karen Velez

- Shailene Woodley Husband

- Chesterkoong

- Jonathan Brandis

- Paryimpson Husband